21 Dec

All-in-one Tax Calculator

BooksPOS all-in-one Tax calculator lets you calculate amount inclusive / exclusive tax. Tax can of any kind: VAT, GST, and other Taxes. Use our Free and Ready-to-use Tax Calculator to determine your sum accurately.

VAT Calculator

The VAT Calculator (Value-Added Tax) can calculate a price before VAT, or a price after VAT rate inclusion. Enter the values in either of the two fields – Price before tax or Price after tax and the required tax rate to compute the third value.

What is VAT?

Vat (Value added tax) is a category of indirect consumption tax levied on the value added to goods or services, especially during various phases of the supply chain, that includes production, wholesale, warehousing, distribution, supply, or any other. Governments use VAT r

VAT (value added tax) is a type of indirect consumption tax imposed on the value added to goods or services, especially during various stages of the supply chain, which may include production, wholesale, distribution, supply, or any other stages that add value to a product. VAT is commonly used by governments around the world as one of their major sources of revenue, and accounts for approximately 20 percent of worldwide tax revenue. It is the most common consumption tax in the world and is enforced in over 160 countries. All countries that are part of the European Union (EU) are legally required to enforce a minimum VAT rate, and since its introduction in the 20th century, European VAT rates have consistently increased. The U.S. is the only developed country in the world that doesn’t use VAT.

VAT Differences between Countries :

While all nations follow an overall VAT outline, there are a great deal of contrasts in the better delicacy of their particular execution. The VAT in one nation won’t be equivalent to the VAT in another. Contrasts between nations incorporate the duties forced on explicit products or administrations, regardless of whether the expenses apply to imports or fares, and rules regarding recording, installment, and punishments. For instance, in the Philippines, they exclude senior residents from paying VAT for most products and a few administrations that are for individual utilization. In China, alongside the standard VAT rate, there is a diminished rate that applies to specific items, for example, books and oils. Many nations don’t force a VAT for specific merchandise going from training to staples, wellbeing administrations, and government charges.

GST Calculator

A GST, or goods and services tax, can be the alternative name of VAT in some countries such as Australia and Canada. In addition, the terms are commonly used interchangeably (sometimes even with “sales tax”), even though GST and VAT in their respective countries can differ tremendously. No country has both a GST and a VAT.

What is GST?

The Goods and Services Tax (GST) is similar to VAT. It is an indirect sales tax applied to certain goods and services at multiple instances in a supply chain. Taxation across multiple countries that impose either a “GST” or “VAT” are so vastly different that neither word can properly define them. The countries that define their “sales tax” as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia.

Sales Tax Calculator

The Sales Tax Calculator can compute any of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.

What is Sales Tax?

A sales tax is a consumption charge paid to the government on the offer of specific products and enterprises. The vendors gather the sales tax from the shopper as the customer makes a buy. In many nations, the sales tax is called value added charge (VAT), or merchandise and enterprises charge (GST), which is an alternate type of consumption charge. In certain nations, the recorded costs for products and enterprises are the before-charge value, and a sales tax is just applied during the purchase. In different nations, the price are after-tax final values, which comprise the sales tax.

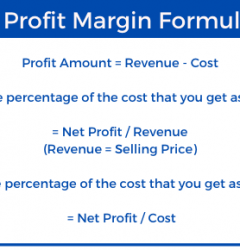

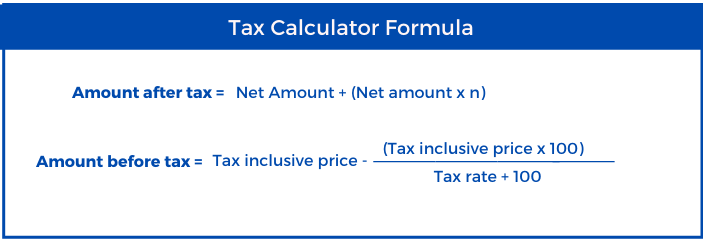

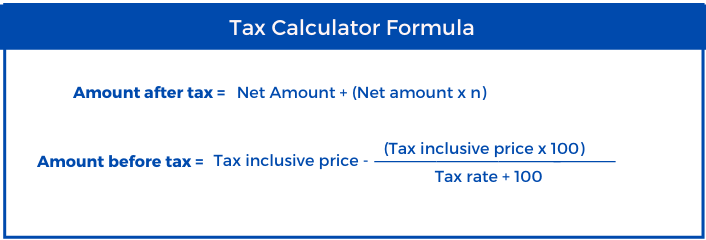

Formula used in the Tax Calculator :

Amount after tax = Net Amount + (Net amount x n)

Amount before tax = Tax inclusive price – (Tax inclusive price x 100/Tax rate + 100)

Where,

- Net amount = Amount before Tax inclusion

- n = Tax rate

- Tax inclusive price = Amount including tax

How Tax Calculator works?

To determine amount before or after tax, you need to:

- Get your net price (Amount excluding tax). Let’s make it

€40. - Find out the tax rate. Let it be

10%in our example. If expressed in percentages, divide it by100. So it’s10 / 100 = 0.10. - Now calculate the tax amount by multiplying the net amount by tax rate.

€40 * 0.10 = €4 - To find out the tax inclusive price, multiply the net amount by tax rate (again, we’d get

€4) rate and then, - Add it to the tax exclusive price so you get the tax inclusive price.

€40 + €4 = €44.

It’s just a specific net-to-gross calculation. However, it is a manual method. To compute it instantly, you can use our Tax Calculator.

Related Tools

Business Startup Cost Calculator | Break-Even Point Calculator | Loan Amortization Calculator | EOQ Calculator | Compound Interest Calculator | Profit Margin Calculator | Total Cost Calculator