03 Dec

Compound Interest Calculator

Interest is the amount paid by the borrower to the lender besides the amount borrowed or the amount earned by the investor over the sum invested.. However, in compound interest calculator, CI refers to the addition of the interests in a principal sum of deposit or loan per month, that you have to pay after a certain or fixed period.

When we continuously reinvest in interests rather than paying it out, we accumulate it to the principal sum for interest of next month. Compound interest is the interest earned on both the principal and on the accumulated interest. Therefore, we can also say it as interest earned on interest.

The theory of compound interest is the base of most financial gears in the world. The interest earned by the lender differs from profit because a lender receives it as a benefit to provide money to the owner of the mortgage asset or investment. However, interest can be a part of a gain on an investment.

To calculate the interest with compound interest calculator consider using,

- Initial Investment / Principal – The amount of money also referred to as principal you have to invest initially.

- Estimated Interest Rate (%) – Your estimated annual interest rate.

- After – The number of years the money is invested or borrowed for.

- Compound Frequency – Times per year, the interest will compound.

Practical Uses of Compound Interest

Starting from the basics, any form of savings that doesn’t earn interest cannot take advantage of the compound interest, for e.g., cash or many checking accounts. Some common funds that take avail the benefit of compound interest include savings accounts, stocks (with reinvested dividends), and some popular retirement programs such as 401(k)s and IRAs.

Investing in compound interests is recommendable financially regarding over simple interest. You get to earn more over principal and accumulated interests. The longer is the duration of the compound interest, the higher will be the growth of your principal sum. While you can benefit it for all instruments, retirement investments are the main and highly opted instruments that people used to earn greater compound interests. You can use our ready-to-use compound interest calculator to check how much you can earn with your sum of principal in time with a fixed rate of interest.

As a basic example, an individual at age 20 invests $3,000 each year for nine years at an 10% interest rate. After some time, they decide to end the annual payments, allowing the funds to grow undisturbed until they reach the age of 65. With an initial investment of only $18,000 over nine years, their funds will have grown to almost $450,000 to use in retirement! Isn’t it great? And all this without paying a single rupee for 38 years. This is because of compound interest.

Though you can grow your wealth very effectively through compound interests, it can also act against you if you are under any debt or loan that is subject to compound interest. This is the reason we define compound interest as a double-edged sword. You might cause paying a vast amount in return of the principal owed under compound interest.

Therefore, you must ensure that the debts get paid off faster as early as you would like to invest in a retirement plan to give it maximum time to grow.

Different Compounding Frequencies

Our compound interest calculator can calculate on any frequency set up. The compound interest calculator allows the conversion between compounding frequencies of daily, semi-annually, annually, quarterly, monthly, and weekly.

Formula used in the Compound Interest Calculator

There are various compound interest calculators for different importances, however, you can do them all in our all-in-one, ready-to-use free tool with these few formulas:

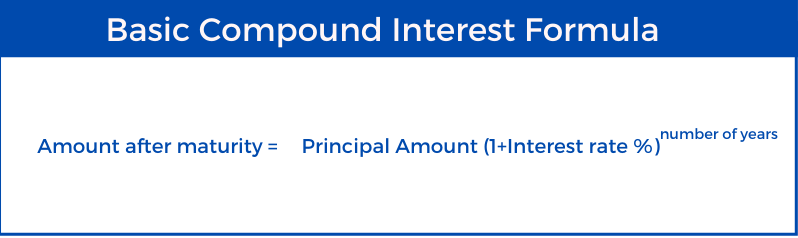

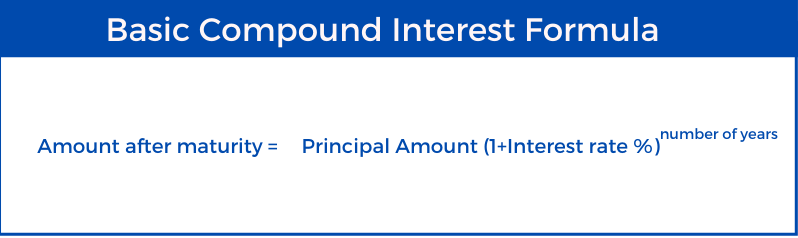

Basic Compound Interest

Basic formula for compound interest calculation is: At = A0 (1+r) n

where:

A0: principal amount or initial investment

At: amount after time t

r: interest rate

n: number of compounding periods, usually expressed in years

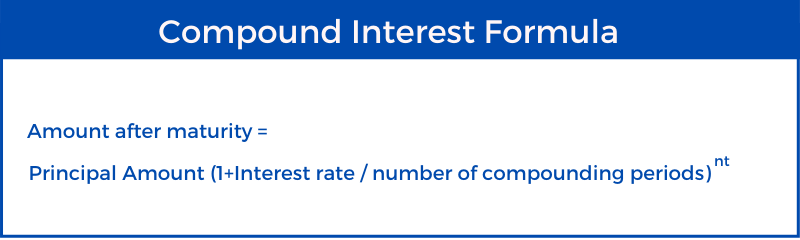

Compound interests with compounding frequencies

For compounding regularities (such as monthly, weekly, or daily), the formula used is, At = A0 × (1 + r/n)nt

where:

A0 : principal amount or initial investment

At : amount after time t

n : number of compounding periods in a year

r : interest rate

t : number of years

Rule of 72

Shortcuts are interesting! Right? The Rule of 72 is a shortcut to calculate the time taken by a specific amount of money or principal sum to double itself, given a fixed return rate that compounds annually. You can use this shortcut for any investment unless there is no fixed rate involved in compound interest. To calculate, simply divide the number 72 by annual return rate. The result of this calculation will be the number of years it’ll take.

However, keep in notice that the Rule of 72 does not prevail on any investment fees, management fees, and trading commissions. It is best used as a raw guideline.

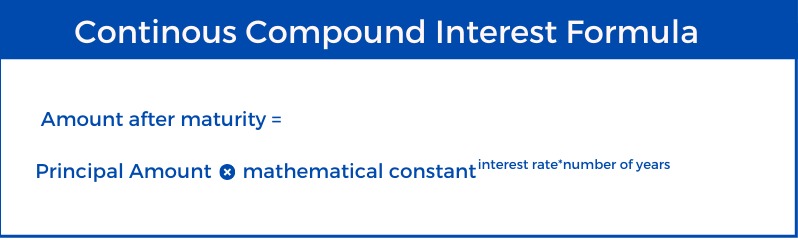

Continuous Compound Interest

Continuously compounding interest shows the mathematical set that compound interest can approach within a fixed time period.

The continuous compound equation is: At = A0ert

where:

A0: principal amount or initial investment

At: amount after time t

r: interest rate

t: number of years

e: mathematical constant e, ~2.718

Examples for Compound Interest Calculator

For more detail, we have explained few examples to help you give a better understanding so you can use the compound interest calculator efficiently.

Example 1

Find the total due at maturity with the details below:

- Principal amount, or initial investment – $1000

- Interest Rate – 6% p.a.

- Number of compounding periods – Once a year

Formula to calculate the compound interest is, At = A0 (1+r) n

- Compound Interest = At = A0 (1+r) n

- Compound Interest = $1,000 × (1 + 6%)2

- Compound Interest = $1,123.60

Example 2

Find the total due at maturity with the details below:

- Principal amount, or initial investment – $2000

- Interest Rate – 6% p.a.

- Number of compounding periods – Daily accumulated

- Number of Years – 2

Formula to calculate the compound interest is, At = A0 × (1 + r/n) nt

The interest earned every day is: 6% ÷ 365 = 0.0164384%

Using the formula above, it is possible to find the value at the end.

- At = $2,000 × (1 + 0.0164384%)(365 × 2)

- At = $2,000 × 1.12749

- At = $2,254.98

Therefore, the end value of $1,000 for 2 years that has a 6% interest rate compounded daily will be $2,254.98.

Example 3

Find the maximum interest that could be brought in on the $1,000 savings account at 6% p.a. in 3 years.

Using the formula for continuous compound interest: At = A0ert

- At = $1,000e(6% × 2)

- At = $1,000e0.12

- At = $1,127.50

FAQs

Q1. Do compound interest give any benefit to the investors?

Ans. When talking about investing money, compound interest is the best friend of the investors. This is because it helps the investments to grow as an interest over interest and principal. You can our above examples and practical uses to ensure how compound interest can grow your wealth without being interrupted.

Q2. Can compound interests help in planning for retirement?

Ans. Compound interests can be of great use when planning for retirement. You can use compound interest in estimating the cost of living after retirement and can earn that living for the rest of the life after retirement.

Inflation is the major reason cost of living after retirement becomes higher. Thus, it becomes the benchmark for how much money an individual needs to save for retirement.

Q3. What are the consequences of borrowing money subject to compound interest?

Ans. Compound interest is your friend but only in case of investments. You might have to repay higher if you owe money on a compound interest basis. Therefore, it’s better to pay off your debt as early as possible.

Q4. How can the compound interest calculator help us?

Ans. Using our compound interest calculator, you can easily calculate the amount due after maturity. Simply put in the values in the required fields and click on ‘calculate’. The result will show you the amount that you need to repay over your debt or you will earn over your investments after a particular period.