08 Dec

Profit Margin Calculator

Profit is one of the most important thing to determine in the world of business. An individual can easily calculate the profits using a profit margin calculator. BooksPOS has built this easy-to-use tool to help you come up with Profit amount, Profit with revenue base and, Profit with cost base. In sales, calculating the key factors is important. These key factors include the cost of goods sold, your profit margin, your selling price or revenue, and the profits amount.

Basically, the profits determine the standing position of the company. If you get a low value from your profit margin calculator, it is your business is in risk. You must ensure a proper action. Therefore, you will need a higher value in your profit margin calculator after entering all the fields.

How to use a profit margin calculator?

Using the profit margin calculator, measure the net profit amount and profit percentage of sales from the cost and revenue. The net profit margin (%) is equals to net profit (or net income) divided by revenue (or net sales). While using the profit margin calculator, consider using the following values :

- Get your COGS (cost of goods sold). For example,

$20. - Get your revenue (at what price you sell these goods for, for example,

$30). - Calculate the profit margin amount by subtracting the cost from the revenue.

$30 - $20 = $10

Further, to calculate the profit margin, in percentage consider the following steps :

- Divide profit margin amount by revenue:

$10 / $30 = 0.3. - Express it as percentages:

0.3 * 100 = 33%. - This is how you determine profit margin in percentage… or easily use our profit margin calculator! You can learn the profit margin percentage based on cost and revenue along with the profit amount.

For a better understanding, margin is a basic percentage. But when opposed to markup, it’s based on revenue rather than COGS.

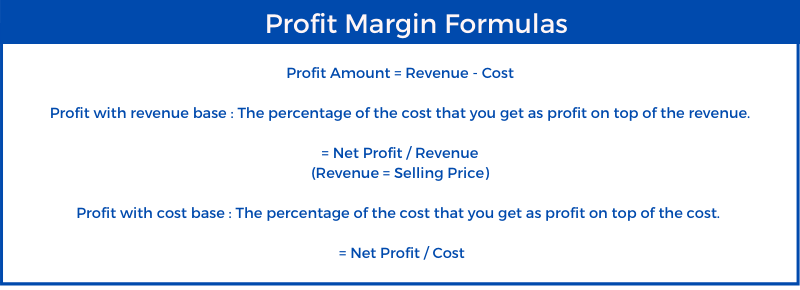

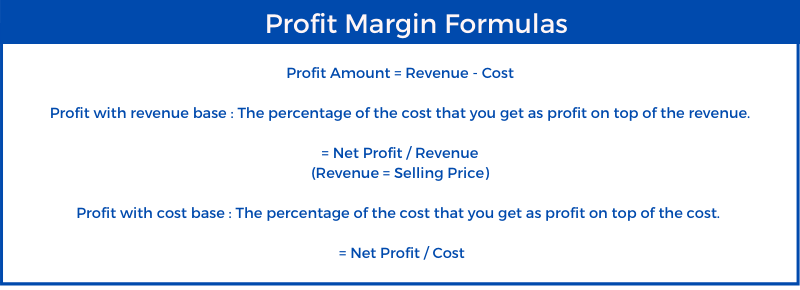

Formulas used in Profit Margin Calculator :

The formulas used in our profit calculator are :

- Profit Amount = Revenue – Cost of goods sold (where, Revenue = Selling Price of the goods)

- Profit margin with revenue base = (Profit Amount / Revenue) *100

- Profit with cost base = (Profit Amount / Cost) * 100

Margin vs Markup

There’s an important difference between gross margin and markup. Though it’s small, it can create a great confusion. The margin is the ratio of profit to the sales price, and the markup is the ratio of profit to the purchase price (or cost of goods sold).

In layman’s terms, we also know profit as either markup or margin when we aren’t dealing with percentages. It’s curious how some people depend on markup while rest think on terms of margin. Markup is more perceptive, yet concluding by the number of searchers who looked for markup calculator and profit margin calculator, the latter is more popular than the former.

FAQs

Q1. What’s the difference between gross profit margin and net profit amount?

Ans. Gross profit margin refers to the profit divided by revenue (the amount earned by sales). Whereas, Net profit margin refers to the profit minus the sum of all costs and other expenses (tax, rent, wages, machinery expenses, etc.), divided by Revenue. While gross profit margin is a helpful part for your business, you can think of the net profit amount as money that ends up being in your pocket. The investors are more likely to look at your net profit amount to check whether your operating costs are being covered. However, our profit margin calculator covers all the values you need.

Q2. What is a margin in sales?

Ans. Sales margin implies the percentage of the output of the selling price of a good or service, minus the costs comprised in producing the service or good to be sold. These costs include taxes, wages, rent, machinery expenses, etc. Though it is like net profit percentage, it is calculated in per unit terms.

Q3. How do I calculate a 30% profit margin?

Ans: You can calculate a 30% profit margin following these steps :

- Express 30% in its decimal form, 0.3.

- Subtract 0.3 from 1 to get 0.7.

- Divide the original price of your good by 0.7.

- You got a number? This new value is the amount of selling price you should charge for a 20% profit margin.

Q4. Are margin and profit the same?

Ans. Though both the terms determine the performance of a business, a margin and profit are not the same. All margins are metrics expressed in percentage terms that aids in comparing things that operate on explicitly on a different scale. Whereas, profits amount is indeed in currency terms, therefore providing an absolute value to compare the day-to-day operations.

Q5. How to calculate markup from margin?

Ans. To calculate markup from margin, follow these steps :

- Divide your margin percentage by 100 to change it into a decimal.

- Subtract this decimal from 1.

- By the product after the subtraction, divide 1.

- Again Subtract 1 from product of the third step.

- You now get the markup expressed in decimal form!

- If you want to express markup in percentage form, multiply the decimal by 100.

Make It All Easy

Striving to get an effective pricing strategy for your business? For this purpose, you must determine your margin and markup. BooksPOS’s ready-to-use tools have a solution for this. You can decide a suitable selling price for your business to attain a good profit margin.