General Resources

Quick Guide to Different Retail Payment Options and How they Work?

- By harshmaur

- No Comments

08 Mar

For retailers, it’s entirely expected to accept money and charge card payment as the only for retail payment option from customers. However, on the off chance that those are the solitary retail payment option you use, you could be losing new customers and passing up freedoms to develop loyalty relationships with existing ones.

According to a survey, nearly 50% of customers who can’t utilize their favored technique for retail payment will desert a buy. What’s more, the other half who wind up purchasing from you? They aren’t seeing the best client experience you can offer.

That is a great deal of avoidable income left undiscovered essentially on the grounds that you don’t accept as many retail payment options as you could.

At the end of the day, the most ideal alternative for retailers is to accept as many number of retail payment options as could reasonably be expected.

Furthermore, fortunately accessing extra retail payment options for their customers is certifiably not a colossal obstacle in the event if you have an adaptable an ideal retail location point-of-sale (POS) system set up.

By understanding the advantages of the numerous retail payment options accessible, you can choose which bode well for your store and your customers. At that point, with the assistance of an adaptable retail POS system like BooksPOS, you can start using many retail payment options effortlessly, making better customer engagement and supporting to nurture the business.

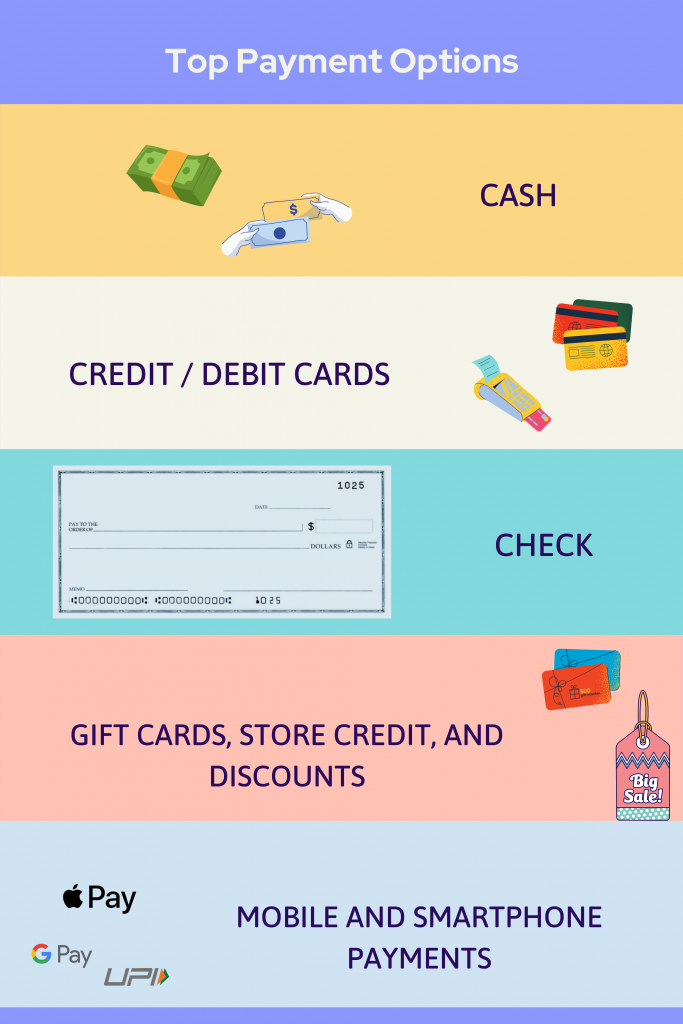

Here are some of the retail payment options explained in brief.

Table of Contents

Cash payments

Money is, obviously, the most essential installment strategy you can acknowledge. Money likewise doesn’t expect you to explore installment processors or stress over expenses.

Regardless of the immense development in Mastercard and versatile installments, approximately 14% of Americans still really like to pay with money. That number is much higher outside of North America, where there is now and again less trust put in banks or charge cards. Japan, for instance, sees about 25% of online shoppers pay in cash with the goal that they may get their online buys at general stores.

While there are a few complexities to taking care of and representing money exchanges, there are not very many drawbacks to allowing your clients to pay with money. On the other side, there are many advantages for both you and your clients:

- Cash is simple and helpful: Especially for those clients who like and convey it consistently.

- Speed: When clients pay with money, their installment is in your grasp (yet not your financial balance) right away.

- No exchange expenses: When you acknowledge money installments, you keep a greater amount of the real cash since you don’t need to cut out installment handling and different charges that Mastercards and other installment types typically bring about.

So, tolerating money installments is as yet expected as table stakes in retail, and there are basically no disadvantages to it.

Credit and debit card payments

Credit and charge (bank-gave) cards have been around for some time, however their utilization is a long way from leveling. Truth be told, research from BAI Research and Hitachi Consulting shows that 41% of consumers are using cash less often, also, 97% of study respondents are going to credit and charge installments all things considered.

To some degree as a result of numbers that way, tolerating credit/charge cards has become the standard. It’s the absolute minimum retailers need to never really pace with buyers and contenders.

All things considered, that is in reality uplifting news for buyers and retailers the same, in light of the fact that there are a great deal of experts to credit and check card installments. Information shows that shoppers go through more while paying with a Mastercard versus money. That is something the Girls Scouts of America realized when they also, 97% of study respondents are going to credit and charge installments all things considered.

To some degree as a result of numbers that way, tolerating credit/charge cards has become the standard. It’s the absolute minimum retailers need to never really pace with buyers and contenders.

All things considered, that is in reality uplifting news for buyers and retailers the same, in light of the fact that there are a great deal of experts to credit and check card installments. Information shows that shoppers go through more while paying with a Mastercard versus money. That is something the Girls Scouts of America realized when they quadrupled annual cookie sales over the earlier year just by actualizing versatile Visa swipers.

What’s more, credit and bank cards:

- Lend stores some credibility: Accepting Visas (explicitly Visa, Mastercard, Discover, and American Express) is normal to such an extent that stores without the capacity to acknowledge card installments might be viewed as “obsolete.”

- Increase deals in general: With an ever increasing number of purchasers swearing off money completely, permitting Mastercard installments implies you can try not to miss out on deals when clients simply don’t convey money.

- Have cash flow benefits Mastercard installments, in contrast to money, are regularly stored into your ledger naturally. While the specific planning can fluctuate starting with one installment processor then onto the next, you can normally anticipate that the money should hit your record not long after a deal is finished.

The one proviso to those advantages? Charges. Preparing Visas implies you’ll need to acknowledge the related exchange expenses that installment processors charge. While these charges can differ, they average between 1.5% and 3% of the total sale.

Check

Checks are a long way from an ideal type of installment. Basically, they are unsafe for the two clients and organizations the same.

Imprinted on checks is a wide range of touchy data, including account numbers and addresses, which means a lost check could open a shopper to wholesale fraud.

In the mean time, checks are moderately simple to phony, and few organizations can perceive the indications of misrepresentation before they are influenced.

Also, they set aside effort to compose, and few organizations will pause.

Except if you are a B2B, you can decide not to acknowledge checks, and you’ll probably be better for it.

Money Orders

Like checks, cash orders are paper records used to make installments. In contrast to checks, cash orders are altogether secure, gave solely after a client has proffered the cash addressed on the request.

Cash orders are generally uncommon types of installment, regularly seen among low-pay clients.

You ought to figure out how to check the validness of cash orders before you choose to acknowledge them.

ACH

ACH (e-check) is an acronym for Automated Clearing House. In brief, it’s a nationwide financial network through which it makes electronic transactions among the financial institutions without the use of paper checks, wire transfers, credit card networks, or even cash. Moreover, the transaction can be a next day settlement or same-day settlement. Also, there is a set of Rules and Regulations (set by NACHA) that allows ACH payments.

Automated clearing house (ACH) payments interface financial balances with charging accounts, so payments are made ultimately. If you are a consumer/firm, who pays/receives bills electronically (not through check or a credit/debit card, or is paid a direct deposit by the employer), then it’s most probable that the ACH network is being operated.

Frequently, this installment strategy is utilized for repeating payments; for instance, managers’ “direct deposit” is an ACH installment made to representatives.

We can make ACH payments to a consumer, corporate, or government. Withal, it allows single or recurring payments. However, keep a note that before every ACH transaction enters the network, it must be formatted aptly according to the standard entry class code.

Examples of ACH payments

Now, as we know what are ACH payments, let’s have a look at some of its examples.

- Payroll – It refers to the amount of money needed to be paid to the employees in a firm.

- Dividends – The part of the profit that a company pays to its shareholders.

- CD Interest – It refers to the compound interest.

- Pensions – It is the fund that the Government offers to the retired government workers.

The Federal Government and NACHA administer the ACH network. Moreover, the ACH payments don’t have to rely on the same ‘PCI compliance guidelines’ for its credit card processing.

Freelancers should demand ACH installment from their customers since it is quicker, safer, and less expensive than different types of retail payment options.

Usually, ACH payments take several business days (the days on which banks are open) to be processed. Moreover, the payment often goes through in batches by the ACH network (that is just opposite to wire transfers that process in real-time).

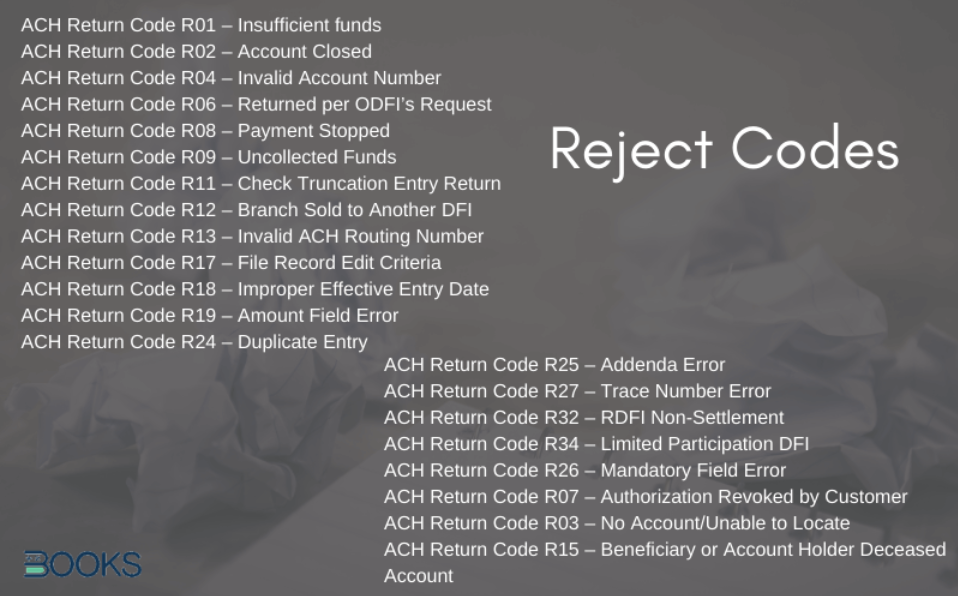

Moreover, if ACH payments are rejected, your bank (OFDI) will send you a reject code. There are many reject codes that explain specifically what happened. The reject codes are vital for providing accurate information to your customer why the payment wasn’t processed.

Mobile and smartphone payments

There’s another retail payment options encountering faster development in the course of the most recent couple of years: versatile and cell phone installments. These incorporate normal cell phone installment alternatives like Apple Pay, Google Pay, and Samsung Pay and are otherwise called contactless installments or mPOS.

Data from Business Insider’s Mobile Payments Report shows the quantity of U.S-based buyers who use in-store versatile installments is relied upon to hit 150 million before the finish of 2020. That number, whenever hit, will imply that 56% of U.S. buyers are utilizing versatile installments for in-store retail buys.

There are a ton of explanations behind that development, however boss among them: versatile installments are quicker and simpler for shoppers who commonly have their telephones out in any case.

Likewise, there are some decision benefits for retailers who acknowledge versatile and cell phone installments, as well:

- Customer accommodation: As referenced, it’s simpler and quicker for clients to pay you thusly.

- There are income benefits: Mobile installments, like credit and check cards, regularly hit your ledger under 3 days after the deal.

- Data accessibility: When clients pay with their cell phones, you can possibly get and follow client information, including how oftentimes they shop with you and the amount they spend, and you can draw in with clients all through the in-store venture (by sending location-based updates on sales, discounts, and more).

Gift cards, store credit, and discounts

Gift vouchers and store credit are one installment technique of the most effective retail payment options that you may not find out about frequently, yet they’re one of a retailer’s most incredible assets in building long haul, faithful client connections. Basically, store credit empowers retailers to develop and continue existing customer relationships, while gift vouchers help acquaint new individuals with your store in a generally safe manner.

Gift vouchers, store credit, and limits are altogether switches you can pull to create better customer retention and loyalty. Additionally, there are a few other key advantages for retailers:

- For one, present cards and store credit urge clients to spend more since they’re probably going to spend more than the gift voucher or credit is worth. Also, clients feel more good going through more cash with your store when they realize you offer an incredible merchandise exchange—it resembles a security net.

- When it comes to returns and trades, giving gift vouchers or store credit in lieu of discounts empowers you to be more adaptable and imaginative. For instance, advertiser Kaleigh Moore shared about an interesting experience she had with a retail return: an organization offered to credit her 120% of the first price tag in the event that she decided on store credit over a money discount.

Further Reading :- Sell More with Store Credit and Reduce Sales Return

Overall the entirety of the advantages, store credit and gift vouchers empower you to keep cash in your environment. Regardless of whether the gift voucher never gets spent or a thing gets returned/traded, that deal stays with your business.

Bank Transfers

Customers took on an online banking service that can do a bank transfer to pay for online buys. A bank transfer guarantees customers that their assets are securely utilized, since every exchange should be confirmed and endorsed first by the client’s online banking qualifications before a buy occurs.

E-wallets

An E-wallet stores a customer’s very own information and assets, which are then used to buy from online stores. Pursuing an E-wallet is quick and simple, with clients required just to present their data once for buys.

Moreover, E-wallets can likewise work in mix with portable wallets using brilliant innovation like NFC (close to handle specialized) gadgets. By tapping on a NFC terminal, cell phones can right away exchange supports put away in the telephone.

Prepaid Cards

Another retail payment option, regularly utilized by minors or clients with no financial balances. Pre-loaded cards or Prepaid cards come in various put away qualities for clients to browse. Web based gaming organizations as a rule utilize pre-loaded cards as their preferred installment technique, with virtual cash put away in pre-loaded cards for a player to use for in-game exchanges. A few instances of pre-loaded cards are Mint, Ticketsurf, Paysafecard, and Telco Card. Apparently age as opposed to pay is the quality that influences the appropriation of pre-loaded cards, as per Troy Land’s research.

Direct Deposit

Direct stores are when clients train their banks to haul assets out of their records to finish online payments. Clients typically illuminate their banks on when assets ought to be pulled out of their records, by setting a timetable through them.

A direct deposit is a typical retail payment technique for membership type administrations, for example, online classes or buys made with excessive costs.

Custom Payments

As we referenced previously, an ideal POS system offers you the adaptability to acknowledge as many—and differed—payment strategies as you and your clients need, and that incorporates custom installments like the accompanying:

- Split installments: The exemplary model here is the point at which a gathering needs to part their café bill among numerous Visas. In a retail climate, this may seem as though two customers together buying a blessing with two credit/check cards.

- Split delicate: For adaptability, customers may like to pay for part of their request in real money and put the lay on a Visa.

- Partial installments: For certain retailers, it bodes well to acknowledge a halfway installment forthright and offer credit or installment plans (like loan) to gather the rest. On the other hand, retailers can acknowledge an underlying installment coming up, and have the client pay the remainder of the bill on the web, which can build normal request size.

- Zero installments or IOU: Similarly, a few retailers may offer loan or other installment plans with no straightforward installment; your POS should have the option to represent these exchanges.

The main advantage of client installments like those above is that they empower retailers to be more adaptable, regularly to the advantage of both the store and the client.

For some physical retailers, custom payments like split method and split tender are a need to take into account to meet customer inclinations and stay aware of their competitions. Notwithstanding, split payments between numerous credit cards may imply that your store causes higher credit card handling charges. Therefore, it’s significant that you take the expenses of offering these custom payment choices into thought.

Retail payment options that’s best for you and your customers

At the point, when you have a POS system that makes it easy for you to accept varied retail payment options, there are actually no downsides to accepting the entirety of the retail payment types your customers need to use.

Offering customers the retail payment adaptability they’re searching for. They spend more, appreciate a superior customer experience, and open up the chance for you to develop and support long haul, faithful customer connections.

For more significant components to consider when pursuing for a retail location pos system, read our POS Guide for Free.

Regardless of which retail payment option you pick, ensure that it is loved by your customers.

You can attempt to do a few overviews to ask clients how simple and helpful your payment cycling is for them.

In the event that clients feel it requires a lot of exertion to make a buy, they will be more averse to do as such on schedule. Opportunities are, in the event that it works for your clients, it will work for your business as well.

BooksPOS – More retail payment options, happy customers.

Increment sales and consumer loyalty by offering your clients the retail payment alternatives they like to pay with.

Faster & error-free

BooksPOS allows you an error free and quicker retail payment options. You can use our integrated payment methods or bring any of your choice to continue. Moreover, with integrated card payment options, sums are consequently presented on your card terminal, so it assists save with timing and lessen mistakes.

Seamless checkout experience

Acknowledge all significant credit and charge cards and let your clients pay with tap, swipe or chip and pin. Many of the BooksPOS integrated payment devices include split payments and allows your customers to pay as per their convenience.

Get the rates you like

BooksPOS integrates with the many leading payment providers. With different choices for each area, pick a payment provider that best suits your business and get the rates you like.

Manage Transactions with BooksPOS

Our software initiates quick and real-time transactions that process within less than 1 minute. The software easily integrates with the existing software including accounting, payments, and so on. You can easily manage payments and further, the software automatically updates your account per sales.

FAQs

Does POS systems provide all security requirements?

It’s not necessary that all POS systems offers you all security measures. Some of them are even prone to danger of leakage of business’s sensitive information. In most of the POS systems, the staff that enters new stock items, are also granted access to all your sales history that can reduce your privacy.

However, BooksPOS solves this problem and gives you a full-proof secured business POS system. It allows you to manage your staff access completely. Save your important business information from being leaked by restricting access to only people you want in your system.

Is your POS software adaptable to your business needs?

Yes, BooksPOS is adaptable to all your business needs. There are variety of businesses that needs an ideal and innovative POS software. So upgrade your POS software with newer versions as regarding your business needs for being adaptable with your specific requirements of your business. Your system needs to be configured well as per your personalized interface to get the right match of your business.

Will I need to pay a monthly fee for using a POS system?

Yes, you’ll have to pay a monthly fee for using a POS system. However, the fee structure varies among POS alternatives.

The fee charged will depend on the business scale and sales processing rate per day.

Further, you might have to buy the software, such as accounting software, CRM software, etc. to make your POS system more efficient. Altogether, this can cost you in a range from $60/month for the most basic features of a POS system to $200+ per month for POS software with moderate features.

Also, some POS systems also charge you an additional transaction fee, that takes a cut off your profit, and reduce your profit-earning capacity.

BooksPOS is different. BooksPOS starts with $29/month per device. It gives more value to the dollar you pay than any other POS software in the industry. BooksPOS allows you to save more by integrating either with a solution that we already integrate with or you can bring your own – either way, we do not take a cut off your sales.

Additionally, BooksPOS natively supports surcharging, allowing you to save a lot more on your credit card transaction fees.

Why BooksPOS?

BooksPOS provides every feature and tool that a small retail owner seeks for his POS system. Also, our software is affordable for every small retailer as well. We don’t eat your profits by charging any additional fees.

BooksPOS understand the needs of small retail owners, so we support them 24*7 to keep their operations running smoothly. So, what are you waiting for?

We hope this blog helped you understand how retail payment options can influence your business or whether it is good for your business. If you still have any queries, you can share it with us in the comment section below. We are always available to you.