01 Oct

Are you a small business owner? What are ACH payments? Or, how does it operate? And most importantly, is it apt for your business? Tangled with these queries? Welcome, you are on the right page! Today, we will discuss everything that you are looking for.

As we know, more and more cheques are converting to electronic transactions daily. Therefore, ACH payments volume is speedily rising, mainly with the invention of same-day processing.

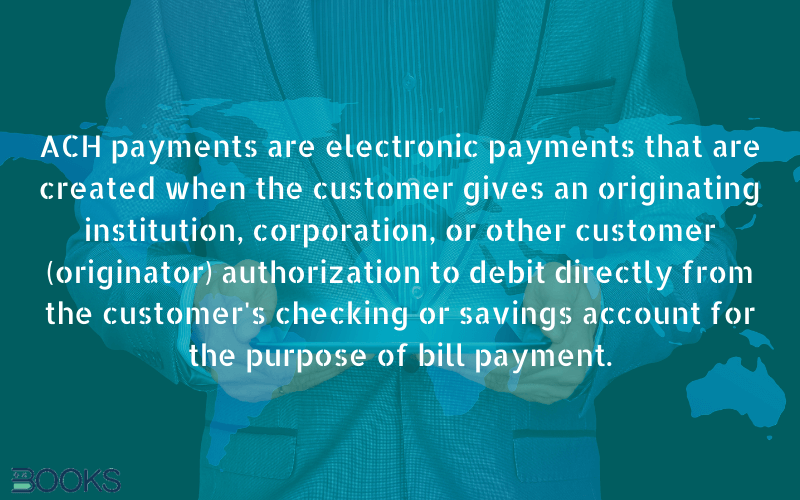

If you are a consumer/firm, who pays/receives bills electronically (not through check or a credit/debit card, or is paid a direct deposit by the employer), then it’s most probable that the ACH network is being operated.

Therefore, consumers and firms are also getting familiar with many types of ACH products and services. So, it’s a good idea to understand the ACH payments and their network.

Table of Contents

What are ACH Payments?

Now, starting from the point, what are ACH payments? ACH (e-check) is an acronym for Automated Clearing House. In brief, it’s a nationwide financial network through which electronic transactions are made among the financial institutions without the use of paper checks, wire transfers, credit card networks, or even cash. Moreover, the transaction can be a next day settlement or same-day settlement. Also, there exists a set of Rules and Regulations (set by NACHA) that allows ACH payments.

ACH payments at a glimpse:

| Origin | ACH payments came into work in the early 1970s with the Special Committee on Paperless Entries (SCOPE). The first ACH Association began in 1972. |

| Governing body | The National Automated Clearing House Association (NACHA) governs the ACH payments and was formed in 1974. |

| Relevant account | The ACH payments are posted to Checking or Savings accounts ultimately to a loan or to GL for corporate transactions. |

| Nature of transaction | ACH payments can be a debit or credit transaction. |

| ACH transaction amount | Can be transferred a large or small amount of money up to $100,000. |

ACH payments can be made to a consumer, corporate, or government. Withal, it allows single or recurring payments. However, keep a note that before every ACH transaction enters the network, it must be formatted aptly according to the standard entry class code.

Examples of ACH payments

Now, as we know what are ACH payments, let’s have a look at some of its examples.

- Payroll – It refers to the amount of money needed to be paid to the employees in a firm.

- Dividends – The part of the profit that a company pays to its shareholders.

- CD Interest – It refers to the compound interest.

- Pensions – It is the fund that the Government offers to the retired government workers.

ACH payments comprise:

| Entry description | Tells the members whether it’s a payment, payroll, or annuity. |

| Company | Tells the account holder where the ACH payments originated. |

| Effective date | The date on which the company or the merchant intends for the item to settle (Yet, it’s not a settlement date). |

| Routing number | It is a sending number of the originating Depository financial institution. |

| Trace number | Used for research by both the originating and receiving institution and also used in the return process. |

How ACH Payments take place?

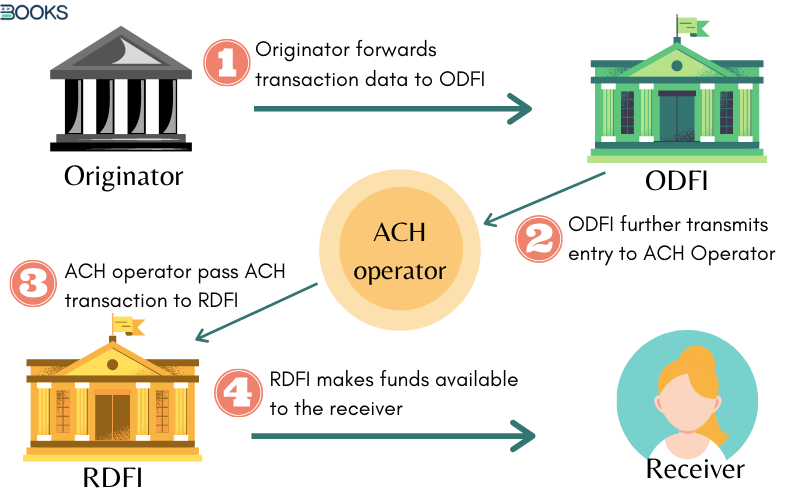

The ACH payments take place in a network. The coordinating bodies involved in ACH transactions are:

Originator

An originator is a party that initiates the ACH payments. Moreover, it can be a company, a government agency, or a person. The originator obtains authorization from the receiver.

Originatory Depository Financial Institution

The Originatory depository financial institution (ODFI) is the institution that initiates the ACH payments after receiving payment instructions from the originator. Also, an ODFI acts as an RDFI or Receiving depository financial institution, in the event of a return.

ACH Operator

The ACH operators are clearing facilities for the financial institutions. There are two ACH operators that participate in the ACH network,

- the Federal Reserve Bank, and

- the electronic payment network

Though both can be involved in a transaction, the main ACH operator is the Federal Reserve Bank.

Receiving Depository Financial Institution

The next ACH participant is the RDFI. This is a financial institution that receives ACH payments for posting to a receiver’s account. An RDFI does not have to operate as an ODFI.

Receiver

The receiver is a party that receives the ACH payments and has authorized the originator to initiate the entry into the network. Again, it may be a company, a government agency, or an individual.

How do ACH payments operate?

ACH payments operate through the ACH network (explained above). Let us use Dee as an example to understand how ACH payment works.

Dee is a newly hired employee in an insurance company. On his first day in the company, Dee handed over his bank account details to his employer for the processing of a direct deposit on his payday.

ACH Credit

In this example, the insurance company is transacting an ACH payment to send a paycheck to Dee.

To start a payment, the company will initiate an ACH payment to its bank, which would consequently debit the insurance company bank account. Further, the bank would pass the entry to its ACH operator. The ACH operator would forward entry into Dee’s Bank, which would, after settlement, credit his bank account.

This credit transaction is also known as a “push” transaction.

ACH Debit

Moreover, as Dee has given his banking details to the company, they are now authorized to pull funds directly from his bank account to pay his bill.

The insurance company, therefore, initiates the ACH entry to its associate bank that passes the entry further to its ACH operator. Following the network, the ACH operator forwards the entry to Dee’s bank. Consequently, Dee’s bank debits his bank account. After settlement, the insurance company’s bank credits its bank account with the amount of Dee’s bill.

This debit transaction is also known as a “pull” transaction.

ACH payments processing time

Usually, ACH payments take several business days (the days on which banks are open) to be processed. Moreover, the payment often goes through in batches by the ACH network (that is just opposite to wire transfers that process in real-time).

According to the guidelines set up by NACHA, the financial institution’s ACH payment processing time may vary from a single business day to in 2 to 3 days. Moreover, an ACH debit payment can be processed by the following business day of making a transaction.

After the other bank has received the transfer, it may also seize the transferred funds for a holding period. Withal, the whole ACH payment processing time may take an average of up to 3 to 5 days for an ACH payment.

However, NACHA has laid down a new rule in September 2016 that states the ACH payments to debit three times a day rather than just one. These changes are enhancing the widespread use of same-day ACH payments for small businesses.

Cost of processing an ACH payment

ACH payments prove to be more affordable for business rather than a credit card. The price is laid down by the merchant provider (or whatever set-up you are using to process your ACH payments).

Some ACH processors are based on a flat rate that may range from $0.25 to $0.75 per transaction. Rest may charge you a flat percentage fee that ranges from 0.5 percent to 1 percent per transaction. An additional monthly fee may also be charged by the providers for ACH payments that may vary.

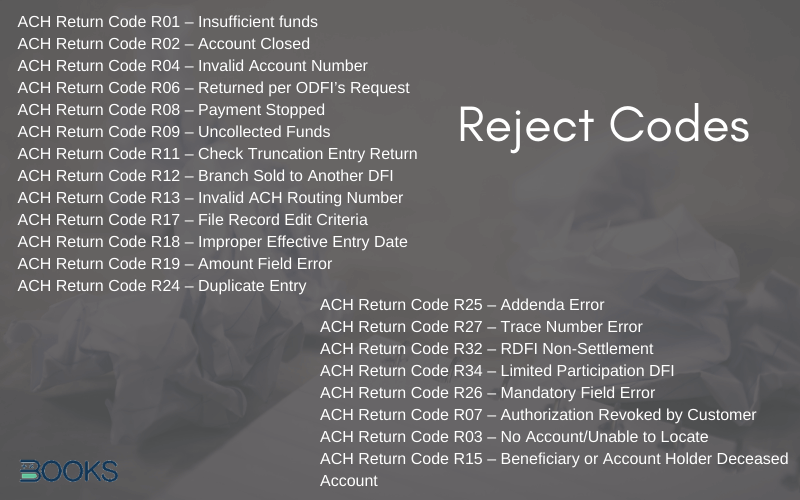

Reasons for rejections of some ACH Payments

Usually, if ACH payments are rejected, your bank (OFDI) will send you a reject code. There are many reject codes that explain specifically what happened. The reject codes are vital for providing accurate information to your customer why the payment wasn’t processed. Here, we have explained the four most common reject codes:

R01- Insufficient funds

This code describes that your customer’s account is not holding the optimum amount required to debit the payment. If you get this code, your customer will probably make a new payment after transferring the required payment amount in the account or offer a different payment method.

R02 – Bank account closed

This code is triggered when the customer’s payment cannot be processed because his/her bank account is closed. This may happen if the customer’s account was previously opened but now it’s closed leading some reason and they forgot to notify the change. Withal, they will have to provide a new bank account to process the transaction.

R03 – No bank account or unable to locate the account.

The R03 code appears either if some combination of the data mentioned (such as the account number or accountholder name) varies from that of the bank’s records or an account number that didn’t exist was entered. Consequent to this, the customer needs to re-check and provide their accurate bank account details again.

R29 – Reject

This code is received when the bank doesn’t permit a business to withdraw funds from a specific account. In this situation, your customer requires providing your ACH Originator ID with your bank to access ACH withdrawals. Further, you require redoing the transaction.

Tips for avoiding return codes

Now that you know why a reject code can be received, let’s look at how to avoid these reject codes that hinder your transactions.

- Before confirming entry, make sure that your customer’s routing or account number is filled accurately. It’s probable to omit a digit or enter anything that is incorrect. When you hasten to transact a bill, it’s possible they are mistyped. Therefore, you must be conscious while entering details.

- If you are using a prepaid checking account, you must ensure that your bank permits receiving ACH credits and debits. As per the R20 reject code, all accounts are not apt for ACH transactions. Therefore, it’d be wise to make sure this isn’t the case.

- Make sure whether you or your customer’s funds have crossed the respective bank account.

If you have received a reject or return code, contact your bank and make sure why this situation did occur.

Penalty fees

You must know that if unfortunately your ACH payments get rejected, you could be handed over with a penalty fee. Therefore, whenever you get a reject code from your bank, it’s vital to resolve the issue as soon as possible to further avoid the additional charge incurred on each recurring billing cycle. To avoid the inconvenience of unraveling ACH payments, it would be wise to only accept payments from your trusted customers.

ACH Payments Security

The Federal Government and NACHA administer the ACH network. Moreover, the ACH payments don’t have to rely on the same ‘PCI compliance guidelines’ for its credit card processing.

Yet, NACHA needs that all the participants involved in ACH payments (involving the businesses that start the transaction and the third party processor) usually on the processes, specific methods, and control measures to safeguard sensitive data. This rule also sets forth that the conveyance of any banking details (like customers routing number or account number) should be protected employing ‘commercially reasonable’ technology.

Therefore, you cannot send or receive the crucial banking information with an encrypted source (like email or insecure websites). Withal, you must make sure that if you are using a third party processor for your ACH payments, they should rely on the systems that are secured and use encrypted methods to protect your critical bank information.

Under the rules set forth by NACHA, the originators that initiate the ACH payments must also take steps that are commercially reasonable to assure the shielding of their customer’s accounts and routing numbers and further to recognize the probable fraudulent activity. Though, almost every third party is ACH processors use these encryptions. Yet, you must make sure to inspect before signing in with anyone. Moreover, to ensure whether your business is processing the ACH payments securely or not, you may appoint a security expert of ACH processing.

Small business loves ACH

ACH payments offer several benefits for a small business. Small business loves using ACH processors. To understand let’s take an example of Jack.

Jack is a hard-working small business owner. His primary focus is to drive his company’s operations with faster and easily executable methods for sending and receiving the company’s payments. This is why; Jack relies on direct deposit and direct payments via ACH. ACH payments processing time is not more than three days.

Direct deposit and direct payments via ACH are the types of electronic payments method that simplifies a business’s payment processes.

Direct deposits

For example, direct deposits or you can say, the electronic delivery of Jack’s employee’s salary is automatically transacted to his or her bank account on every payday that ensures that employees get their money on time. This makes the employees happy and motivated, and Jack also is relieved.

Even when things don’t go as expected, for example, at the time of payday computer crashed and Jack met the payroll deadline. Thankfully, ACH direct deposit has a solution for this too! Now Jack can simply use same-day ACH that offers quicker payment options by his financial institution to pay his employees’ salaries on their payday without any delay.

Using ACH, Jack can easily pay his business’ hourly and temporary employees via ACH direct deposit. Therefore, now he has more time to assess for the hours worked before submitting payroll.

Direct payments

As Jack has successfully made direct deposits, he also loves to use direct ACH payments to pay his vendors and business suppliers. Jack admires the control that direct ACH payments offer him. Whenever Jack makes a payment with a direct payment method, it is electronically transferred from his business bank account ultimately to the receiver’s bank account. If Jack needs to make a payment on a regular basis or monthly basis, he can easily set up recurring payments for the expenses that are required to be met periodically (such as insurance).

Using direct ACH payments also enables other businesses to pay electronically. Besides its flexibility, Jack adores the cost-effectiveness with direct payment. Moreover, using direct payments with ACH is safer and more secure rather than paying with a paper check.

Withal, a smart business owner knows direct deposit and direct payments are safe, secure, reliable, timesaving, and cost-saving. Therefore, small business loves using ACH that offer you the best above all.

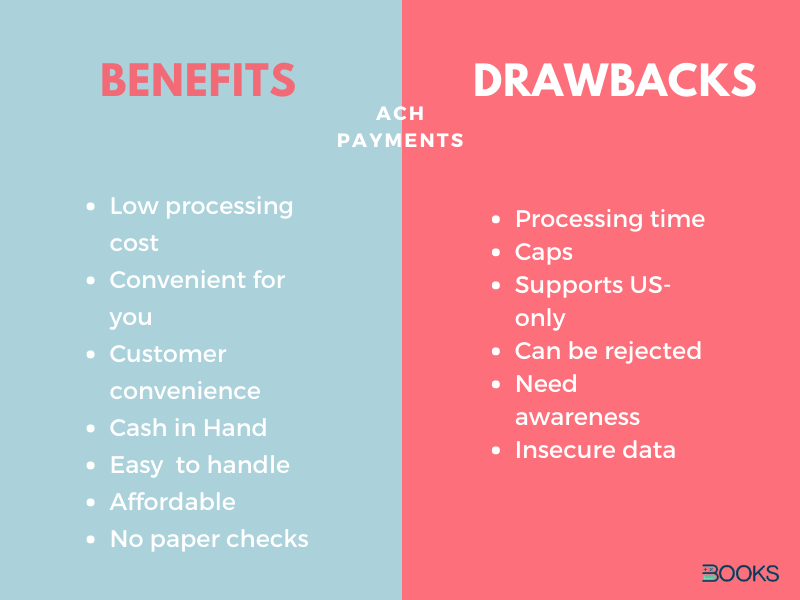

Benefits and Drawbacks of ACH payments

Benefits of ACH payments

ACH payments have become a center of attraction for all businesses today. It provides several benefits and convenience to the businesses.

Low processing cost

As compared to the other payment processes, the ACH payment charges comparatively the lowest processing fees for any type of payment. Moreover, if you are using a provider with a flat rate, an ACH payment processing would not cost you out of pocket such as credit cards.

Convenient for you

As an electronic payment method, there exists no more paper invoices, checks, or time-taking trips to the bank.

Customer convenience

A business that provides various payment options to the customers holds up their attention. Moreover, with ACH payment processing, the customers don’t have to look up for their checkbook anymore.

Drawbacks of ACH payments

Though the ACH payments are convenient and offer several benefits, it has its own set of drawbacks.

Processing time

The ACH payments processing time may take about several days to process – at least three to five business days (five days includes return transactions).

Caps

There are monthly Caps or say limits on how much money you can transfer. As per NACHA, a same-day ACH allows a maximum amount of $25,000 per transfer limit.

Supports US-only

It’s probable that your bank doesn’t accept the ACH transactions to and from international bank accounts.

Transaction management with BooksPOS

Books’ POS is an integrated and point of sale payment solution in real-time. Our software allows you to accept credit cards or mobile payments from a mobile device, tablet, or counter. It is an electronic point of sale software that makes your transaction management simpler and easier.

Our software initiates quick and real-time transactions that process within less than 1 minute. The software easily integrates with the existing software including accounting, payments, and so on. You can easily manage payments and further, the software automatically updates your account per sales. REQUEST Free Trial DEMO NOW!

We hope this blog helped you understand how ACH payments operate or whether it is good for your business or not. If you still have any queries, you can share it with us in the comment section below. We are always available to you.