18 Feb

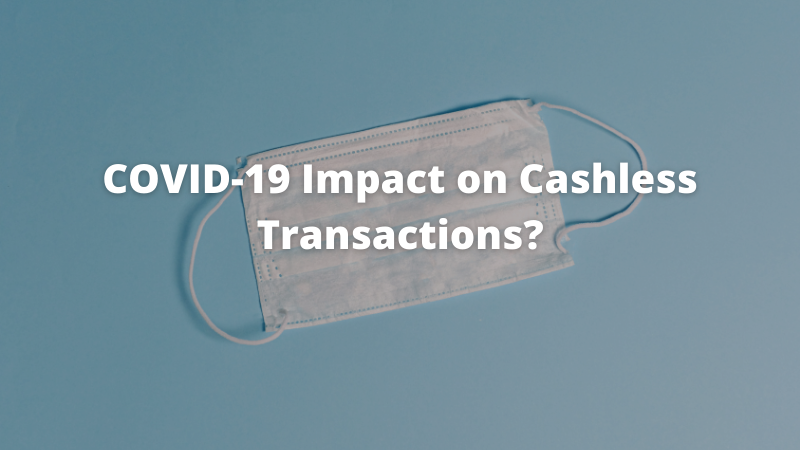

Fear of contact with the virus made a drastic impact on use of cash in business. People started using cashless transactions.

To use cashless transactions in your business, you need a POS system. An ideal pos system helps you to manage your business efficiently.

While the whole world has started using cashless transactions since a decade ago, India has been held back in this case. Though India has the very technologies to be a cashless economy, still we are lacking. The main reason for this is mainly the fear of losing money via a faulty transaction.

Another threat that covers most of the Indians is that is too simple for someone to secretly hack into their devices and take away all their money. However, besides this it is a good option to be cashless and try over digital payments. Here, we will tell you why!

First, in this article we will learn about how COVID-19 has influenced the use of cashless transaction in the last year.

Table of Contents

What is a Cashless Transaction?

Basics are important! So, let’s begin from here.

Cashless transactions are the payments done without cash, i.e., through cards, mobile payments, etc.

A cashless transaction refers to an automated and online platform for making money transfers between two people, businesses, firms, or companies. A cashless transaction is mostly referred to as a digital transaction in its simpler meaning.

A digital transaction is a cashless mode of transaction that particularly comprises no paper for completing the transaction. You might have performed digital transaction many times. While purchasing goods from e-commerce websites, signing business contracts on online platforms, buying movie tickets online from an app, working from home, and so on. These all fall under the categories of digital payments.

Such methods are reliable, accurate, smoother, quicker, convenient, and most importantly easier. Many are unwilling to accept the benefits of cashless transactions due of threat, fear of losing money, or either they don’t know much about digital advancement or simply they don’t want to. However, there are many benefits associated with cashless transactions. Moving forward, we will tell you an array of digital transactions that makes day-to-day operation easier.

COVID-19 impact on cashless transactions

Since the coronavirus pandemic started last year, use of cashless transactions has increased rapidly. It just accelerated the gradually growing trend. However, this leads to more payable charges and fees for merchants that ultimately leads to higher prices for merchants. For instance, swipe fees for the merchants.

Cash Is Not King in the Time of Covid-19

Through researches are experiments, many medical experts have stated that coronavirus is less probable to transit through paper currency. Though it’s not a major source of transmission, it hasn’t stopped the merchants to drift away from cash transactions. Instead, they are choosing for no-contact payment methods over cash use.

Moreover, this pandemic made the economy touch-free. The interactions that by-chance involve cash, such as in-store shopping, or ordering a pizza for home delivery, or tipping the delivery driver, these all are being replaced by no-contact delivery, online tipping, curb side pickup, and shopping online.

However, merchants are also resisting the use of cash. The rate of “cashless transactions in businesses” almost climbed up in merely less than two months after the pandemic started. It rapidly raised up from 8% on March 1 to 31% on April 23.

Merchant Fee Increases on Hold but Scheduled to Rise

Earlier this year, both Visa and Mastercard were scheduled to rise up their merchant swipe fees. However, they postponed the schedule for increase due to the severe pandemic situation. Though it’s not clear whether they will get back to schedule now or later, the increase will definitely affect the merchants and consumers pocket more than the changes we have seen in the past days.

The main reason for this is the fact that customers using cash payments have helped reduce the cashless counterparts by cutting off the amount merchants have to pay in swipe fees. Yet, now the situation has changed. More customers are opting for cashless transactions methods. Therefore, merchants will be tempted to increase the price to maintain the profit margin.

Cash Remains the Only Option for Many – A Serious Drawback

Besides, a certain number of people don’t have a bank account. Therefore, they have no means to pay other than cash. Up to 10% of citizens are “unbanked”, meaning they don’t have any saving, checking, or current account.

Due to this, for the unbanked people, cashless transactions methods are usually out of reach. And if this continues, and the consumers’ paying habits drifts more towards a cashless society, that will probably leave the “unbanked” out of economy.

Seeing this trend issue, many countries like New York, San Francisco, and others are in process to pass a firm law that says merchants have to accept also the cash payment besides digital payments. Federal legislation, the Payment Choice Act of 2020, is also working to forbid merchants from disowning cash, pasting notices like they don’t accept cash here, and charging customers higher prices.

What are the types of cashless transaction you can rely on?

There are various methods you can reply on cashless transactions method. Here are some of the top ways to aid you direct your path into a cash-free world.

Cheques and Demand Drafts

Cheques have been one of the oldest and reliable method of payment without cash. A cheque is issued by a drawer to the drawee, that is a person or business stating a specific amount for payment. Further, this cheque is deposited in the receiver’s bank. They payment is processed by the clearing house and the receiver gets the money in this bank account.

A demand draft is however safer than a cheque. This is due to the surety of no default and dishonor. The demand draft cannot be defaulted or dishonored so the receiver is assured of the payment. A banker signs the DD and makes sure that there is enough of balance available for a successful transaction.

The only limitation of using cheques and demand drafts is that there processing time is too long. It is time-consuming because as the person requires to visit the bank. Further, they have to wait for the cheque or DD to clear.

Debit and Credit Cards

Debit cards and credit are one of the best traditional method of cashless trading. Many people consider a debit card to be safer. This is because debit card allows you to transact money directly from one bank to another without any use of paper or formalities.

A credit card is too useful. However, there’s a risk with it. A credit card allows you to overspend, therefore, spend more than your balance. And this overspending is counted as an overdraft that the cardholder needs to pay later with interest.

Debit cards and credit cards helps to make online purchases as well as in-store purchases.

UPI Applications

UPI is an acronym for Unified Payment Interface. It is a modern era evolution for online payments. UPI diverted the way we used to transact. An UPI application works by registering our mobile number and verifying it with the associated banks that are linked to the number given for registration.

UPI includes a virtual payment address. A VPA allows you to transfer money without entering any bank related details. Also, you can use a UPI application for any of your accounts – savings or current.

Some most popular UPI applications in trend are BHIM, Phonpe, Google Pay / Tez, Paytm, ICICI Pocket, and SBI Pay.

Mobile Wallets

One of the most convenient ways of making payments without cash is the Mobile Wallets. You simply need to load your money in the wallet balance. Further, you can use it wherever it is accepted. The most popular mobile wallet trending nowadays is Paytm.

However, there is one disadvantage of using mobile wallets. Once you add your money in the wallet, you can only use the balance if the merchant does not accept through the app you said.

NEFT & RTGS

NEFT is an acronym for the National Electronic Fund Transfer and RTGS stands for Real Time Gross Settlement. They are electronic ways of making transactions to the merchants. This electronic payment system allows you to transfer funds conveniently between bank accounts.

Both NEFT and RTGS are maintained by RBI – Reserve Bank of India. Moreover, these two facilities can only be used within India. You can make RTGS transfers during bank working hours and on weekdays from 8 am to 4.30 pm. The NEFT transfers take place in deferred batches on bank working days.

However, you won’t get any “stop payment” option in between of any of the transaction once proceeds, The payments made are irrevocable in either of the payments system.

IMPS

IMPS is an acronym for the Immediate Payment Service. The National Payment Corporation of India started IMPS service to make transactions easier without cut-off time for transactions.

However, the IMPS user is required to register for mobile banking. Once you register for mobile banking, you can avail the benefits and services of IMPS even via internet banking. Moreover, you can send and receive money 24×7, and there is no cut-off time for transactions. To use IMPS, you need the receivers MMID (Mobile Money Identifier), or IFSC code and bank account number.

IMPS is considered fluent than NEFT and RTGS as it is received instantly, without time delay.

POS Terminals

POS (Point of Sale) is known as the location or segment where a sale happens. For a long time, POS terminals were considered to be the checkout counters in malls and stores where the payment was made. The most common type of POS machine is for Debit and Credit cards, where customers can make payment by simply swiping the card and entering the PIN.

With digitization and the increasing popularity of other cashless online payment methods, new POS methods have come into the picture.

USSD

USSD is an acronym for Unstructured Supplementary Service Data. USSD is for those who don’t use smartphone or tablet. It is a cashless option for those who don’t use smartphones or tablets in daily life. It is a type of mobile banking, but the difference here is that it works without an internet connection, opposing the other digital payment methods.

To use this system, you need to dial *99# from your number linked to your bank account to avail the service. The service is same as that of IMPS service, as it uses MMID with a mobile number or IFSC code with the account number to complete the transaction successfully.

ECS

ECS is an acronym for Electronic Clearance Service. It is a simple and easy way to make payments in bulk. It is commonly used to pay off your utility services, equated monthly instalments, and for commercial companies to contribute amounts like pensions, salaries, or divided interest.

We can use ECS for debit as well as credit services. Authorisation has to be handed over to your bank for periodic debits or credits to be made. It is a reliable system because we can give instructions concerning maximum amount to debit, validity time for the said decree, or purpose of the transfer of money.

QR Codes

QR codes can be seen as an extension of the mobile wallet payment or upi payment services. To use this system, you simply need to scan the code of the merchant’s mobile payment application QR code to complete the transaction.

QR code scanning can be done with a smart device with decent camera with a scanning facility. It is a quicker, easier, and hassle-free method to transfer the funds digitally.

Banking

Net banking is an alternative to using your debit or credit card. The user needs to login to their net banking account to approve a payment. Net banking gives you the flexibility of transacting even if you have misplaced your debit card or lost it. You can use internet banking to make utility payments, purchase goods and services online, or send and receive money.

Gift Cards or Vouchers

Gift vouchers are a handy way of going cashless and are a great gift idea because the receiver can decide what they would like to purchase with the voucher. Stores also give out discounts on gift vouchers which work well for the purchaser as well.

What are the benefits of Cashless Transactions?

There are a number of benefits considering a cashless economy. Though India is running slow to become a smart and cash-free economy, cashless transactions here have seen a sudden peak since the last few years.

Here we have listed some of the benefits:

No need to carry cash everywhere

The first and foremost advantage of a cashless economy is that an individual does not need to carry cash with him or her everywhere, which in turn reduces the chances of theft from the wallet, inconvenience due to carrying cash, gives freedom from the problem of change when the transaction is of an odd amount and assures no risk of receiving counterfeit currency and so on.

Ease to track illegal money

Another benefit of a cashless economy is that it is easier to track black money and illegal transactions because if cash is used directly for doing transactions then it is not easy to track the transactions as the money does not come into the banking system. However, in the case of digital transactions, it is easy to track the transaction as all records are there with the banks which results in a more transparent transaction, which in turn leads to a fall in corruption in the economy of the country.

Ease and convenience

One of the most significant advantages of digital payment is the seamless experience they provide to customers. Reduced dependency on cash, fast transfer speed, and the ease of transacting makes online payments a preferred option. Traditional payment methods like cash and cheques add to factors like risk, steps, and physical presence. With digital payment, you can send and receive funds from anywhere in the world at the click of a button.

Economic progress

Customers transact more online when they see the ease, convenience, and security of online payments. This means that more and more people feel comfortable buying online, investing digitally, and transferring funds via electronic mediums. The increase in money movement and online business contributes to the progress of the economy. This is why online ventures are being launched every day and even more are making profits daily.

Safety and efficient tracking

Handling and dealing in cash is a cumbersome and tedious task. Along with the risk of losing money, there is the hassle of carrying cash everywhere you go and keeping it safe. With digital payments, one can keep their funds secured in online format effortlessly. Nowadays, your mobile phone alone is enough to make and receive payments – thanks to UPI, netbanking, and mobile wallets. Additionally, most digital payment channels provide regular updates, notifications, and statements for a customer to track his funds.

A better economy

Another advantage of a cashless economy is that since all transactions will be done through an organized channel i.e., through banks and financial institutions, it results in an increase in tax revenue for the government, as all cash transactions which were done illegally come into the banking system, which in turn helps the government in tracking all transactions and levying tax on them. This can be used by the government for the betterment of the economy of the country.

Other Benefits

- Being a cashless economy furthers the cause of digitisation and takes us one step closer to utilising technology at its finest.

- Physical thefts and robberies will reduce with a reduction in cash circulation.

- The printing cost for currency will come down by and large. Fake currency issues will also reduce.

- Cards and Mobile Wallets are handier to carry around and take up less space than cash.

- It becomes easier to follow your expenditure because everything is tracked online.

- Discounts and cashbacks are being offered for making online payments. Reward points are also being offered by mobile wallets and UPI applications to entice more users.

- Service tax has been waived on card transactions up to ₨ 2000.

- Transacting online improves your budgetary discipline. Having less cash in your wallet forces you to cut down on the smaller yet regular expenses that sneak up into your expenditure list.

- Transacting online can help you with exact amounts. This means that there is no fighting for small change or paying an extra rupee because you are short of coins.

- In case of loss or theft of cards, it can be blocked within minutes to prevent misuse.

POS System – A great way to cashless business

Want to make a cash-free business?

Retails allowing cashless transaction is becoming a sensational trend in the retail world as the technology and public health, both impacts commerce. Nowadays, consumers are carrying less cash in their pocket, and digital or cashless transactions are more prevalent.

The cashless transactions comprise not only debit or credit card payments, yet they also include other contactless payments (like Apple Pay) and mobile online payments (such as Google Pay or PayPal). Many stores have shifted towards being cashless as a response to the coronavirus pandemic, pushing us the economy to becoming a cashless society.

While fully cashless stores — businesses that do not accept cash at all — still aren’t the norm in America, they are becoming more prevalent, particularly as coronavirus concerns have caused many merchants to cut out the potential health risk of handling germy cash, in favor of safer credit card and contactless payments. Digital payments are also quicker than cash transactions and can allow for social distancing during the checkout process. Some cashless transactions systems even allow customers to pay directly from their phones by scanning a QR code on a screen or printed receipt.

In addition to making things safer for your patrons and cashiers, going cashless can also make for more streamlined and data-rich transactions. For example, let’s say a customer makes a purchase on a BooksPOS point of sale system using a credit card or mobile wallet. You (the merchant) will automatically obtain the customer’s email address from the last time they paid with that card on a BooksPOS, allowing you to send them an email receipt or sign them up for your loyalty program. Going cashless may also save money, as you won’t have to deal with the cost of handling and transporting cash. Customers also tend to spend more when they’re paying with a card rather than cash.

In the broadest sense, any credit card machine can make a POS system cashless. But which POS systems really take it to the next level and make it safe and easy to go cashless? A truly great cashless POS will include features, such as strong security, contactless payments, better reports, a strong offline mode to accept credit cards even if the internet goes out, and eCommerce integrations that support online ordering and in-store pickup. Opt for the best cashless transactions solutions that make it easy for your business to go cash-free.

FAQs

How are digital payments better than cash?

Digital payments are much easier and safer than cash payments. They are much more convenient than cash payments as well. Since they are digital, you do not have to carry cash as well.

What are the different security requirements of digital payments?

The different security requirements of digital payments are mentioned below:

1. Confidentiality

2. Integrity

3. Authentication

4. Availability

5. Authorization

6. Non-repudiation

What are the objectives of digital transactions?

The main objectives of digital transactions are to reduce the costs and risks of handling cash and to increase the ease of conducting transactions.

How do digital payments work?

Payments that are done over mobile channels and the internet are digital payments. Digital payments can also be defined as any payments that are done online via the internet or mobile-enabled services.

How are digital payments important?

Since digital payments reduce the costs of providing poor people with financial services, they have become a vital tool in improving financial inclusion. The convenience and safety of using insurance, payments, and savings products also increase by using digital payments.

How Can I Transfer Money to Another Bank Account Online?

You can use NEFT, RTGS, or IMPS to transfer money to another bank account. NEFT and RTGS are services provided by the Reserve Bank of India. UPI applications have also made account to account transfer very easy.

Is There Any Charge for Net Banking?

Different banks have different slabs that they charge for NEFT and RTGS transactions. For example, State Bank charges ₨.1+GST at 18% on transactions up to ₨. 10,000/- while multinational banks charge ₨.2.50+GST for the same slab. RTGS charges start at ₨. 5 and increase depending on the amount being transferred.

How Do Mobile Wallets Work?

Mobile wallets hold digital information about your credit or debit cards, or they hold virtual money transferred from your bank account via IMPS or internet banking. The application uses information transfer technology such as Near Field Communication or QR codes to interact with the merchant payment terminal.